|

Recent Trends and Developments in Employment, Labor & Benefits Law

Employment Matters Monthly

OcTober 2014

Through our Employment Matters blog, attorneys from Employment, Labor & Benefits Practice share noteworthy information on matters relating to employers’ complex human resource and employment law issues. This issue of Employment Matters Monthly includes a list of our September 2014 blog posts and additional timely insights on legal developments.

If you have any questions, please contact us or one of our team’s attorneys.

You can subscribe to our Employment Matters blog here.

Written by Daniel Long

September 30th, 2014

A federal court has tossed the EEOC’s controversial lawsuit against CVS seeking to invalidate its severance agreements. While the EEOC still has a similar lawsuit pending against another company in Colorado, employers can breathe a sigh of relief for the moment.

Back in February, in Equal Employment Opportunity Commission v. CVS Pharmacy, Inc., the EEOC alleged that CVS’s standard severance agreement interfered with its employees’ rights to file discrimination charges with the EEOC and to participate in EEOC investigations and that by interfering with these rights, CVS violated Section 707 of Title VII, which prohibits employers from engaging in a pattern or practice of resisting the rights that Title VII protects.

Continue Reading …

Written by Michael Arnold

September 25th, 2014

Life is about to get a little bit simpler for federal contractors and subcontractors, as far as collecting veterans’ hiring data for the DOL goes. Today, the DOL published a final regulation that relieves the VETS-100 and VETS-100A reporting burden. HR managers will no longer have to classify vets into subclasses of protected vets, under the new VETS-4212 reporting system, which will be in play in September 2015 and thereafter. The VETS-4212 Report looks at the big picture for contractors, and should make data collection and categorization much more simple for folks in HR.

For more specifics on the new, simplified system, our colleague, Jonathan Cain, Member in Mintz Levin’s Government Contracts Practice, summarizes it in this alert: “VETS-100 and 100A Veteran Hiring Reports Retired by the Department of Labor.”

Written by David Katz

September 24th, 2014

The inclusion of a “no-rehire” provision in a separation agreement is fairly commonplace. Likewise, a damages provision (including liquidated damages and attorneys’ fees) in the event of a breach by the former employee is routinely included as well. In practice, however, what happens when a terminated employee tests the limits of a no-rehire provision to which she agreed? Exhibit A is Schiavi v. AT&T Corp., decided in August by a New Jersey appellate court.

Continue Reading …

Written by Jillian Collins

September 23rd, 2014

McDonald’s, the fast food giant known for supersizing its orders, avoided conditional certification of an FLSA collective action this week based on the “very large” size of the putative class. The Eastern District of Michigan denied plaintiffs’ motion for conditional collective action certification in two related cases based on allegations that McDonald’s and several franchisees failed to pay workers minimum wage.

Continue Reading …

Written by Jennifer Rubin

September 19th, 2014

Following up on the piece I wrote with Jim Ninivaggi, “Whose LinkedIn Profile is it Anyway?,” the information contained in an employee’s LinkedIn contacts were discussed in the context of trade secrets in a recent California Federal District Court case, Cellular Accessories for Less, Inc. v. Trinitas.

Continue Reading …

Written by Robert Sheridan

September 18th, 2014

Recently I had a conversation with my father about his options for parental leave when I was born (1979). As a new father myself, I was curious what leave options were open to baby-boomer dads. My father told me that it was fairly standard to take a day or two off after the birth of a child and to then return to the office, with cigars and tired eyes.

While attitudes and policies towards paid leave for fathers have changed since 1979, paid parental leave for fathers is still relatively rare in the United States. This post will briefly examine the issue of paid parental leave for fathers and address some of the practical and legal principles that a company considering paid parental leave should take under consideration.

Continue Reading …

Written by Brandon Willenberg

September 17th, 2014

The collective sobbing you may have recently heard from the west coast of the United States was that of California employers in response to Governor Jerry Brown’s September 10, 2014 signing of AB 1522 – California’s new paid sick leave law called the Healthy Workplaces, Healthy Families Act of 2014. California employers already have myriad employment laws to track, comply with and administer. And given the sheer volume and complexity of California’s employment laws, strict compliance is often challenging enough for employers. The new paid sick leave law will add to that challenge.

Continue Reading …

Written by David Barmak

September 17th, 2014

The District of Columbia is on the verge of joining the 13 other states (and numerous cities and counties throughout the country) that have enacted “Ban the Box” laws prohibiting or limiting an employer from asking job applicants about their criminal records.

Continue Reading …

Written by Alden J. Bianchi

September 5th, 2014

Following up on our Week 22 ACA Countdown to Compliance post, yesterday, the D.C. Court of Appeals granted the government’s petition for en banc review in Halbig v. Burwell, which held low income subsidies to purchase coverage through public insurance exchanges established by the Affordable Care Act were unavailable to residents of states that failed to affirmatively establish public exchanges. The decision by the full court to hear the case vacates the earlier decision of the three-judge panel. This decision is potentially significant. Generally, the Supreme Court is far more likely to accept cases in which there is disagreement among the federal judicial circuits. Should the full D.C. circuit reach a different result, as is expected, then it is possible that once the remaining challenges are decided, there may well be no split in the circuits. Before today, the conventional wisdom was that this case would be decided by the Supreme Court. Now it appears that the conventional wisdom may have it wrong. At a minimum, the odds-makers might want to make some adjustments.

Continue Reading …

Written by George Patterson

September 3rd, 2014

In the past few years the National Labor Relations Board (“NLRB”) has taken an increased interest in whether workplace policies prohibiting employees from discussing the terms and conditions of their employment on social media such as Facebook and Twitter violate the National Labor Relations Act (“NLRA”) by interfering with workers’ rights to engage in concerted activity. Federal law prohibits an employer from interfering with employees who come together to discuss work-related issues for the purpose of collective bargaining or other mutual aid or protection, and the NLRB has (correctly) noted that social media has become one of the primary avenues through which employees engage in such activity. A spate of recent decisions makes clear that the NLRB has intensified (and will likely continue to intensify) its scrutiny of employer social media policies and this scrutiny extends no less to non-unionized employers.

Continue Reading …

Written by Gauri Punjabi

September 2nd, 2014

Recently, litigation consultant TrialGraphix Inc. sued its competitor FTI Consulting, Inc. and four former high-ranking employees in New York Supreme Court for allegedly scheming to steal its trade secrets and gain access to its clients. The complaint alleges that despite signing restrictive covenant agreements, the former employees resigned under suspicious conditions and then went to work for FTI. At least one of the former employees also encouraged TrialGraphix customers to follow him to FTI, the complaint says. In light of these actions, TrialGraphix claims that FTI was seeking to obtain an unfair competitive advantage over TrialGraphix that would have “decimate[d]” its business in New York.

Continue Reading …

Written by Michael Arnold

September 30th, 2014

This summer’s FIFA World Cup was truly spectacular. I know this because I’ve been working in the same office building for years and not once has every one of the 10+ pubs located within a five-block…

Continue Reading …

Written by Michael Arnold

September 29th, 2014

Sadly, for this writer, Yankee legend Derek Jeter’s playing days have come to a close. This summer we were able to watch the Captain and five-time World Series Champion take the final swings of his illustrious…

Continue Reading …

Written by Michael Arnold

September 25th, 2014

Thirteen-year-old pitching sensation Mo’ne Davis made headlines this summer as she became the first female to throw a shut-out in a Little League World Series game. She dominated batter after batter and looked mature beyond…

Continue Reading …

Written by Michael Arnold

September 24th, 2014

It felt like we were in a dream. Or maybe San Diego. Day after day, 82 degrees and little humidity. In a word: pleasant. We know next summer probably won’t be the same, but we sure…

Continue Reading …

Written by Michael Arnold

September 23rd, 2014

61 hot dogs in 10 minutes. Let me repeat: 61 hot dogs in 10 minutes. That’s an incredible 6.1 hotdogs per minute! But for competitive eating champion Joey Chestnut, it was just another day at the…

Continue Reading …

Written by Tyrone Thomas

September 22nd, 2014

The advent of a playoff system in Division I FBS college football is not the only new change in intercollegiate athletics. After the most active summer in the history of…

Continue Reading …

Written by Michael Arnold

September 19th, 2014

“I told my wife I wouldn’t drink tonight. Besides, I got a big day tomorrow… . Well, um, actually a pretty nice little Saturday, we’re going to go to Home Depot. Yeah, buy some…

Continue Reading …

Written by Michael Arnold

September 18th, 2014

This summer, those (31?) of us who watched Chris Pratt steal scene after scene in Parks & Recreation saw him ripen into the star we always hoped he’d become. First he charmed audiences as the voice…

Continue Reading …

Written by Michael Arnold

September 17th, 2014

While it seems like it happened forever ago, it was just back in July when LeBron James once again held this nation captive over where he would play basketball. Four years ago, he jumped ship to…

Continue Reading …

Written by Michael Arnold

September 16th, 2014

$113.6 million and counting — that’s the total amount donated to the ALS Association since July 29 as a result of the Ice Bucket Challenge. Just to put that fundraising number into perspective, the Association raised…

Continue Reading …

Written by Michael Arnold

September 15th, 2014

Am I wrong for thinking out the box from where I stay? Am I wrong for saying that I choose another way? Those are the opening lyrics to Nico & Vinz’s (catchy would be an understatement)…

Continue Reading …

Alden Bianchi, Chair of the our Employee Benefits & Executive Compensation Practice, provides a weekly installment on the Affordable Care Act as he counts down to the January 1, 2015 ACA pay-or-play deadline). Below are the posts from September. Access all of Alden’s posts here.

Written by Alden J. Bianchi

September 29th, 2014

For purposes of complying with the Affordable Care Act’s employer shared responsibility rules (which are codified in Internal Revenue Code § 4980H), employers must identify their “full-time employees.” Final regulations issued under Code § 4980H provide two principle testing methods for making this call: the “monthly measurement method” and the “look-back measurement method.” (The final regulations are available here. See here for a useful IRS summary). In recently-issued Notice 2014-49, the Internal Revenue Service offers proposed approaches that employers may use when addressing changes in and among measurement methods, including:

- A change in the look-back measurement method (e.g., where an employee transfers within an employer from a position for which one measurement period applies to a position for which a different measurement period applies); or

- Where the measurement period applicable to an employee changes (e.g., an employer changes the measurement method applicable to employees within a permissible category).

Continue Reading …

Written by Alden J. Bianchi

September 22nd, 2014

The Treasury Department and the IRS had a busy week issuing no less than five Affordable Care Act guidance items, consisting of:

- Filer instructions for Form 8962 (Premium Tax Credit/Advanced Premium Tax Credit);

- Filer instructions for Form 8965 (Exemptions);

- a Notice on the Patient-Centered Outcomes Research Institute Fee;

- a Notice on Additional Permitted Election Changes for Health Coverage under § 125 Cafeteria Plans; and

- a Notice on Shared Responsibility for Employers Regarding Health Coverage – Approach to Changes in Measurement Periods/Methods.

This post addresses item (iv), i.e., IRS Notice 2014-55 (relating to modifications to qualifying events for cafeteria plan relief). Next week’s post will explain item (v) relating to employees changing status under the Employer Shared Responsibility rules implementing the look-back measurement method.

Continue Reading …

Written by Alden J. Bianchi

September 16th, 2014

A recent Washington Post article (“Glitch in health care law allows employers to offer substandard insurance,” September 12, 2014) highlights an Affordable Care Act compliance strategy being marketed heavily (and adopted widely) in industries that traditionally did not previously offer coverage to large cohorts of variable hour and contingent workers. (We discussed these arrangements in a previous post. The strategy — which is referred to commercially as a “minimum value plan” or “MVP” — involves an offer of group health plan coverage that, while similar in most respects to traditional major medical coverage, carves out inpatient hospital services.

The Washington Post article (and other commentary) engages in some hand-wringing about why these plans are inconsistent with the goals of the Act. One commentator fumed that an employer that offers these arrangements should “examine its conscience.” (Readers might recall a similar bout of hand-wringing that accompanied “skinny” plans.)

It’s time to take a breath.

Continue Reading …

Written by Alden J. Bianchi and Edward A. Lenz

September 8th, 2014

Whether an employer makes the requisite offer of group health plan coverage is critical to the application of the Affordable Care Act’s employer shared responsibility rules as reflected in final implementing regulations issued earlier this year (and see here for a useful IRS summary of those rules). The rules are codified in a newly added provision of the Internal Revenue Code, i.e., Code § 4980H. Generally, Code § 4980H imposes penalties or “assessable payments” where “at least one full-time employee” qualifies for subsidized coverage from a public exchange, and either:

- An “applicable large employer fails to offer to its full-time employees (and their dependents) the opportunity to enroll in minimum essential coverage under an eligible employer-sponsored plan … for any month,” or

- “An applicable large employer offers to its full-time employees (and their dependents) the opportunity to enroll in minimum essential coverage under an eligible employer-sponsored plan …” but that coverage is either unaffordable or fails to provide minimum value.

There is no shortage of commentary on the particulars of the Code § 4980H assessable payments. Surprisingly little attention has been paid however — either by the regulators or the commentators — to what, exactly, it means to make an offer of coverage.

Continue Reading …

Written by Alden J. Bianchi and Edward A. Lenz

September 3rd, 2014

With two seemingly simple and straightforward definitions in the final regulations implementing the Affordable Care Act’s pay-or-play rules — i.e., definitions of “employer” and “employee” — the Treasury Department and IRS have raised a host of concerns for third party staffing arrangements. (The IRS has provided a useful summary of the final regulations in a set of Questions and Answers.) Both definitions adopt the “common law” standard. In so doing, there is no evidence that the regulators intended to change prior law. But unwittingly or otherwise, the preamble to the final regulations provides ample evidence that the industry’s view of these terms is at odds with that of the regulators.

Continue Reading …

Written by Michael Arnold

September 10th, 2014

My colleague Bridgette Wiley in the Health Law Practice authored a blog post entitled Government Issues New Rules for Religious Employers, But Health Plans, TPAs, And PBMs Are Still On The Hook To Provide Contraceptive Coverage in which she describes new rules that have been established for eligible organizations to take advantage of the religious exemption from providing coverage for contraceptive services. However, health plans, TPAs and PBMs are still obligated to offer or arrange separate payments for contraceptive services.

Continue Reading …

September 24th, 2014

Massachusetts Lawyers Weekly recently republished a post by my colleague, Gauri Punjabi, addressing employee poaching. You can check it out here.

Continue Reading …

September 23rd, 2014

My colleague Tyrone Thomas was quoted in a New York Times article entitled In Domestic Violence Cases, N.F.L. Has a History of Lenience in which he comments on the lighter punishments the NFL has historically handed down to football players charged with domestic violence. The article focuses on the disparity in punishments under Commissioner Roger Goodell’s personal conduct policy, especially as it relates to domestic violence allegations.

Continue Reading …

September 22nd, 2014

My colleague Don Schroeder was quoted in Bloomberg BNA’s Daily Labor Report article entitled To Unions, McDonald’s Joint Employer Status No Slam Dunk, as Fast Food Push Intensifies in which he comments on the impact of social media in continued worker organizing efforts and McDonald’s new burden to prove the franchiser/franchisee relationship due to a recent NLRB announcement. The article focuses on the state of the fast food industry following the NLRB general counsel’s authorization of complaints that regional offices treat McDonald’s USA LLC as a joint employer with its franchisees.

Continue Reading …

September 8th, 2014

I was quoted in this timely article by Law360 about fantasy football in the workplace. Conclusion: it’s a workplace reality that’s going nowhere, and therefore, employers should address its presence, and do so in a way that meets their business goals, comports with their culture and reduces their exposure.

Continue Reading …

September 2nd, 2014

My colleague Jen Rubin was quoted in this SHRM article entitled Workplace Racism Persists, Diversity Training Needed, in which she comments on ways employers can ensure effective diversity training programs. The article focuses on racism in the workplace and steps employers can take to decrease its prevalence in their companies.

Continue Reading …

September 2nd, 2014

Law360 quoted my colleague Don Schroeder in an article entitled NLRB ‘Like’ Ruling Sheds Light On Social Media Protection in which he comments on the new standards this decision brings to social media cases. The article focuses on this significant NLRB ruling on an employee’s legal rights on social media.

Continue Reading …

Does Silicon Valley Have a Contract-Worker Problem?, by Kevin Roose (Daily Intelligencer, Sept. 18, 2014)

US Labor Board Orders CNN to Rehire Fired Workers, by Tom Raum (ABC News, Sept. 15, 2014)

Delaney v. Bank of America Corp., 13 Civ. 184 (2d Cir. Sept. 5, 2014) (per curiam) (affirming summary judgment in employer’s favor on employee’s federal age discrimination and breach of claims).

Motivating the Negative Nancy on Your Team, by Zeynep Ilgaz (Entrepreneur, Sept. 2, 2014)

As Arrest Records Rise, Americans Find Consequences Can Last a Lifetime, by Gary Fields and John R. Emshwiller, Wall Street Journal (Aug. 18, 2014)

Employers Worldwide Step Up Investments in Workers’ Wellness; Look to Wellness to Drive Company Performance, Xerox Newsroom (Aug. 6, 2014)

“Looking at social media as part of the screening of applicants puts employers in a vulnerable position. Even if they just take a glance at it, they are immediately presented with a plethora of information about protected statuses.”

EEOC Assistant Legal Counsel Carol Miaskoff at a September 15, 2014 Federal Trade Commission public workshop entitled “Big Data: A Tool for Inclusion or Exclusion?” where she addressed the potential risks employers take by using “big data” in the workplace.

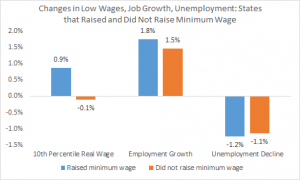

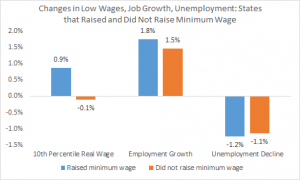

This week, playing the role of Quote of the Week, will be the Chart of the Week below, courtesy of On the Economy Blog.

A new report says that states that recently raised their minimum wage had a higher job growth rate than in those states that did not.

“An employer shall also include prevention of abusive conduct as a component of the training and education specified in subdivision (a).”

California’s new requirement that employers add bullying as a component of their statutorily required sexual harassment training and education programs.

“41 percent of American workers do not plan to use all their paid time off in 2014, even though it is part of their compensation.”

From “Overwhelmed America: Why Don’t We Use Our Earned Leave?” presented by the U.S Travel Association (August 2014)

“So, what will the growing popularity of fantasy football cost the nation’s employers in terms of lost productivity? More than $14 billion, according to one estimate.”

From Challenger, Gray & Christmas’s annual fantasy football report.

Learn more about Employment Matters blog and its contributors here.

|