Changing World of Raising Capital

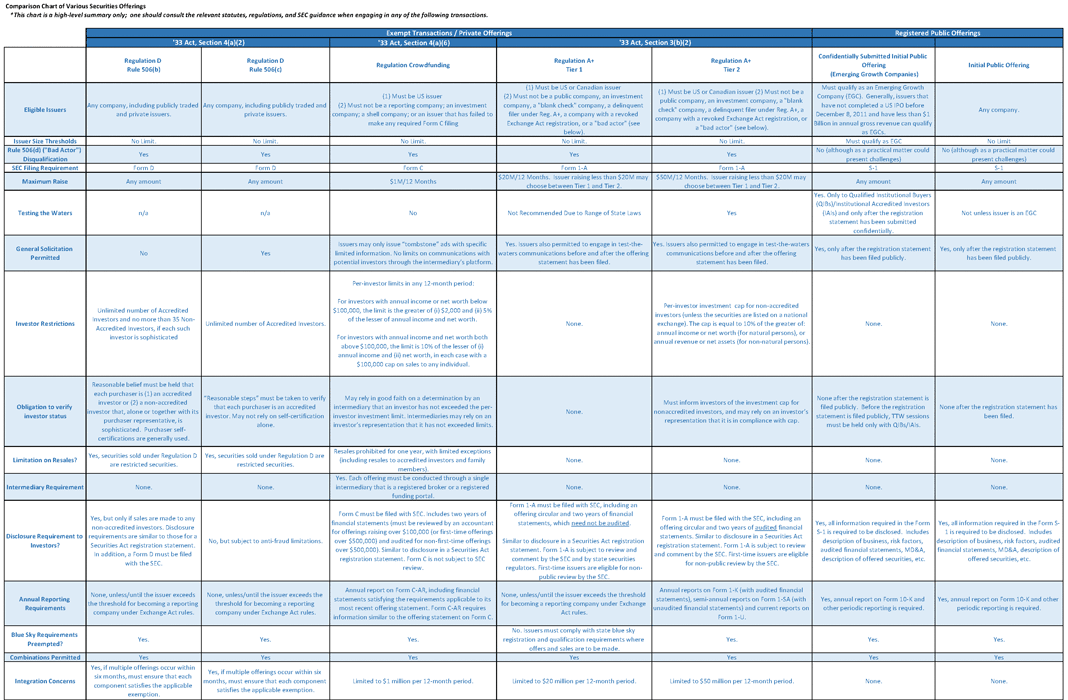

The world of raising capital changed over the last several years. Offerings of securities generally used to fall into two main buckets: (i) private placements under the old Rule 506, or (ii) a public offering. With the implementation of various provisions of the JOBS Act now mostly complete, the array of choices has increased exponentially and include crowd funding, crowd sourcing by general solicitation for accredited investors, IPO light under the new Reg A+ rules, and confidentially submitted initial public offerings. No one size fits all and issuers, bankers, and legal counsel should look carefully as to the context of the situation to determine which format makes the most sense for a particular offering. We thought it might be helpful to provide a chart of the various alternatives for offerings now available.

CLICK IMAGE BELOW TO OPEN PDF

Authors

Daniel I. DeWolf

Member / Chair, Technology Practice; Co-chair, Venture Capital & Emerging Companies Practice