Health Care Qui Tam Update

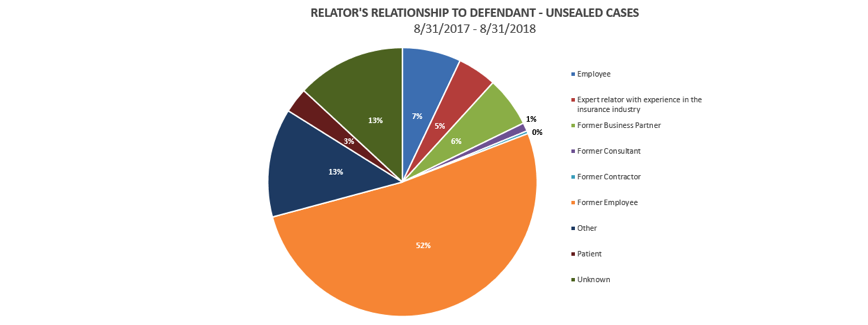

In this issue, we provide an overview of 62 recently unsealed qui tam cases and take an in-depth look at four of those cases. Two of the featured cases concern alleged schemes to provide unnecessary therapy to residents of skilled nursing facilities, while another illustrates the government’s increasing use of claim information from the Medicare database to investigate potential false claims. In addition, we discuss health care qui tam litigation trends based on filings in the 12-month period that ended on August 31, 2018, including the continued diversification of case filers. Although current and former employees still file the majority of qui tam cases, a growing number of relators are former business partners or consultants, industry experts, and patients.

Overview of Qui Tam Activity

- We identified 62 health care-related qui tam cases that were unsealed in June and July 2018.

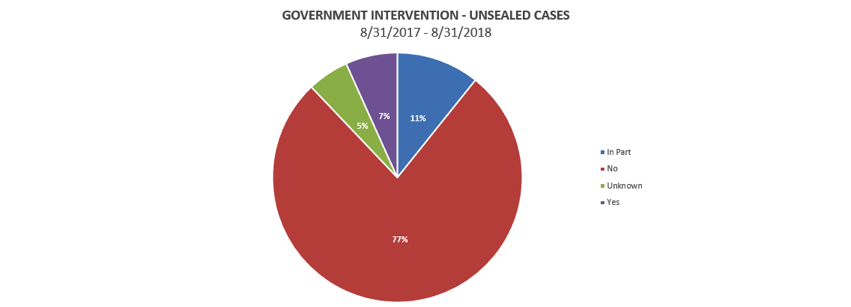

- The government intervened in whole or in part in 16% of those 62 unsealed cases. This is consistent with the overall intervention rate during the prior 12 months.

- Twenty-five of the 62 unsealed cases were dismissed in their entirety and two settled. Thirty-four cases — or 55% of the cases we identified — were ongoing as of the time of our search. The status of one case could not be determined from the unsealed documents.

- The 62 unsealed cases were filed in 37 different courts. The active Middle District of Florida (Jacksonville, Orlando, and Tampa) once again led all jurisdictions, with five unsealed cases. Four cases were unsealed in the Eastern District of Pennsylvania (Philadelphia), the Middle District of Tennessee (Nashville), and the Southern District of Florida (Miami, Fort Lauderdale, and West Palm Beach). The Eastern District of California (Fresno, Sacramento), Northern District of Georgia (primarily Atlanta), and Northern District of New York (Syracuse, Utica, Binghamton, and Albany) each had three unsealed cases, while the Central District of California (Los Angeles), the Eastern District of Michigan (Detroit), Middle District of Georgia (Macon), Southern District of Ohio (Cincinnati), Western District of Washington (Seattle, Tacoma), and Southern District of New York (Manhattan, Bronx, and Westchester County) had two apiece.

- Eleven of the 62 unsealed cases were brought against hospitals and hospital systems. Other frequently-sued defendant types included outpatient clinics, pharmaceutical or biotech companies, and physicians or physician practice groups, which were named as defendants in seven of the 62 unsealed cases.

- Former employees brought 44 of the 62 cases, accounting for 71% of the 62 unsealed cases. Another five relators were current employees. Two cases were brought by former business partners of the defendants.

- None of the cases was unsealed within the 60-day period specified by statute. The shortest time under seal was 92 days, while the longest time under seal was six years and eight months. The average time under seal for this group of unsealed cases was 671 days, or just under two years. However, 15 cases — or just about a quarter of the 62 unsealed cases — were unsealed within one year of filing.

Featured Cases

United States ex rel. Emerson v. Signature Healthcare, LLC, No. 1:15-cv-00027 (M.D. Tenn.)

Complaint Filed: March 27, 2015

Complaint Unsealed: June 7, 2018

Intervention Status: The government intervened on December 4, 2017 for purposes of settlement.

Claims: False Claims Act (“FCA”), 31 U.S.C. § 3729 et seq.

Defendants’ Businesses: Defendants own and operate approximately 115 long-term health and rehabilitation centers providing skilled nursing services to patients.

Relators: Kristi Emerson and LeeAnn Tuesca

Relators’ Relationship to Defendants: The relators are currently employed by Signature Healthcare as occupational therapists.

Relators’ Counsel: David W. Garrison, Jerry E. Martin, and Seth Marcus Hyatt of Barrett Johnston Martin & Garrison, LLC, and James E. Barz and Robert K. Lu of Robbins Geller Rudman & Dowd LLP.

Summary of Case: The relators, both occupational therapists at the Signature Columbia facility in Tennessee, alleged that Signature Healthcare engaged in a company-wide scheme to defraud the U.S. government by billing Medicare for unnecessary physical, occupational, and speech-language therapy, or for services that were purportedly never provided to patients. Specifically, the relators claimed that Signature Healthcare’s regional officers and managers demanded that 90% of its Medicare Part A patients who were receiving therapy needed to be placed in the Ultra High (RU) or Very High (RV) Resource Utilization Groups (RUGs), regardless of patient need for physical or speech therapy or ability to tolerate such levels of therapy. These regional officers and managers allegedly inflated therapy times to artificially elevate patients to higher paying RUGs and also encouraged others to record therapy minutes for patients who did not receive therapy. In addition, the relators claimed that these regional officers and managers demanded that Medicare Part B patients be scheduled for unnecessary therapy when there were not enough Medicare Part A patients at the facility to keep productivity high. Signature Healthcare also allegedly routinely failed to bill physical therapy co-pays to Medicare Part B patients to avoid objections to the unnecessary therapy.

Similar allegations were advanced in a related case, United States ex rel. Burdett v. Signature Healthcare, LLC, No. 3:15-cv-00497 (M.D. Tenn.), in which the relators were Jacqueline Burdett, Signature Healthcare’s Medical Records Director, and Steve Appleton, a Licensed Physical Therapy Assistant employed at Signature Healthcare’s Westmoreland facility in Tennessee. There, the relators alleged that Signature Healthcare was engaged in a company-wide scheme to defraud the government by billing for unnecessary therapy sessions and sessions that were not actually provided to Medicare and TRICARE patients.

Current Status: The United States intervened on May 30, 2018 and entered into a Settlement Agreement with the defendants on June 8, 2018. Pursuant to this Settlement Agreement, defendants agreed to pay $30 million to the United States, plus interest at 2.375% from November 9, 2017, and contingency payments up to $5 million. The settlement amount is payable in installments, due in full by June 30, 2024. In addition to the Settlement Agreement, Signature Healthcare agreed to a Corporate Integrity Agreement with the Office of Inspector General for the Department of Health and Human Services (“OIG”), which became effective as of May 25, 2018. The complaint was dismissed and unsealed in part on June 14, 2018.

Reasons to Watch: This case is in line with a 2015 OIG report, entitled “The Medicare Payment System for Skilled Nursing Facilities Needs to be Reevaluated” and the OIG’s 2016 Work Plan, which announced that the OIG planned to review skilled nursing facility (“SNF”) compliance with the SNF prospective payment system rules. The OIG is aware that SNFs are more frequently billing Medicare at the highest RUGs for therapy, even though reported beneficiary characteristics remain constant and do not indicate a higher need for therapy. As this case demonstrates, SNF therapy times will continue to be subject to scrutiny to ensure that providers are not artificially recording higher RUGs to achieve higher reimbursement.

United States ex rel. Davis v. Southern SNF Management, Inc., No. 1:13-cv-00384-WS-M (S.D. Ala.)

Complaint Filed: July 29, 2013

Complaint Unsealed: July 17, 2018

Intervention Status: The government intervened on July 13, 2018 for purposes of settlement.

Claims: FCA, 31 U.S.C. § 3729 et seq.

Defendants’ Businesses: Defendants are management companies that own and operate multiple skilled nursing facilities in Florida and Alabama.

Relators: LaWanda M. Davis, Tramercier J. Donald, and Megan Dinkins

Relators’ Relationships to Defendants: The relators are licensed therapists formerly and currently employed at SNF facilities owned and operated by Defendants.

Relators’ Counsel: Samuel A. Cherry, Jr. of The Cochran Firm; Casey M. Preston, Gary L. Azorsky, and Jeanne A. Markey of Cohen Millstein Sellers & Toll, PLLC; and Sarah Hubbard of The Hubbard Law Firm

Summary of Case: The relators alleged that the defendant management companies implemented a scheme across the SNFs they managed to defraud the U.S. government by billing Medicare and TRICARE for unnecessary physical, occupational, and speech-language therapy or for services that were never provided to patients. Specifically, the relators claimed that Southern SNF Management demanded that all or almost all Medicare and TRICARE patients receive the amount of therapy time needed to be placed in the Ultra High (RU) Resource Utilization Group (RUG), regardless of whether patients needed physical or speech therapy or could tolerate such levels of therapy. Allegedly, SNF managers also falsely inflated therapy times to artificially elevate those patients to higher billing RUGs. In addition, the relators claimed that Southern SNF Management demanded that terminally ill and otherwise frail Medicare beneficiaries with severe cognitive impairments be assigned to unnecessarily high levels of therapy and as a result of the strain caused by such therapy were injured or died.

Current Status: The United States intervened on July 13, 2018 and entered into a Settlement Agreement with the defendants on July 18, 2018, pursuant to which defendants agreed to pay $10 million to the United States. The complaint was dismissed and unsealed in part on June 14, 2018.

Reasons to Watch: Similar to the Signature Healthcare cases summarized above, this case highlights the risks healthcare management service organizations may face when encouraging the SNFs they manage to record higher therapy times to affect RUG assignment and thereby increase reimbursement.

United States ex rel. Erickson v. Insys Therapeutics Inc., No. 2:16-cv-02956-JLS-AJW (C.D. Cal.)

Complaint Filed: April 29, 2016

Complaint Unsealed: May 11, 2018

Intervention Status: The government intervened on April 13, 2018.

Claims: FCA, 31 U.S.C. § 3729 et seq., Anti-Kickback Statute (“AKS”), 42 U.S.C. § 1320a-7b

Defendant’s Business: Defendant Insys Therapeutics, Inc. (“Insys”), a pharmaceutical company, is the maker of Subsys, an oral fentanyl spray used for the treatment of cancer pain in adults.

Relators: Allison Erickson and Sara Lueken

Relators’ Relationship to Defendant: Relators are employees of Prime Therapeutics, a pharmacy benefits manager (“PBM”) that processed Medicare Part D claims for Insys.

Relators’ Counsel: Bart D. Cohen of the Law Office of Bart D. Cohen; Jeffrey S. Gleason, Jamie R. Kurtz and Jill S. Casselman of Robins Kaplan LLP.

Summary of Case: Insys manufactures a fentanyl drug known as Subsys. The FDA approved Subsys to treat cancer patients suffering from severe pain but did not approve the drug for any other use. Medicare only pays for Subsys if the patient has cancer and is opioid intolerant (i.e., cannot be treated effectively for pain using conventional opioid drugs). The relators, employees of a PBM that administered Medicare Part D prescription drug plans, alleged that Insys falsified patient information to obtain the PBM’s approval to prescribe Subsys to Medicare patients. The relators alleged multiple instances of calls to the PBM by people identifying themselves as employees of prescribers seeking approval to prescribe Subsys to their patients whom relators later realized were actually Insys employees. These employees were supposedly part of a no-cost service agreement between Insys and prescribers in which the Insys unit would seek Medicare authorization on behalf of the medical professionals. According to the relators, Insys employees provided false information about patients to ensure that a prescriber’s request was approved, even though many of the patients did not actually qualify for Subsys because they were not suffering from cancer.

The United States intervened on April 13, 2018, and filed a complaint in intervention alleging two additional acts of misconduct against Insys. First, the United States claimed Insys operated a “speaker program” that was ultimately a way to disguise unlawful kickbacks to prescribers. Insys allegedly paid large sums of money to prescribing doctors to produce presentations about Subsys, but the physicians ultimately did not provide any substantive presentations. Allegedly, many of the speaker program participants only presented to their own office staffs, with many of such staff members attending multiple presentations. Moreover, according to information from the Medicare claims database, the participants in the speaker program were among the largest prescribers of the medication, with some of them prescribing millions of dollars of government-reimbursed Subsys. Second, the United States alleged that Insys targeted its marketing strategy to patients not suffering from cancer. Thus, the government’s complaint contended that most of the presentation speakers specialized in fields other than oncology and management urged Insys representatives to push for off-label sales.

Current Status: In August 2018, Insys announced that a settlement in principal had been reached by the parties. However, no final settlement agreement has been officially filed in the court at this time. The court unsealed the case in part on May 11, 2018.

In December 2016, the federal court in Boston unsealed an indictment of several top Insys executives for alleged criminal violations arising from the scheme alleged in the qui tam actions described above. A superseding indictment was unsealed in October 2017 naming Insys founder John Kapoor. All defendants have pleaded not guilty, and the criminal case is likely to go to trial sometime in 2019.

Reasons to Watch: This case sits at the intersection between fraud and abuse enforcement and the country’s persistent opioid crisis. The approved indications for prescribing Subsys entail only a small risk of abuse because use is limited to palliative care for terminal cancer patients. Off-label prescribing of powerful opioids such as Subsys results not only in false claims but also has the potential to exacerbate opioid dependence and abuse in patients suffering from chronic pain. As such, cases at this intersection will continue to be a strong focus for government action.

The kickback claims in this case also provide an example of the growing enforcement focus on inducements offered to physicians and prescribers by pharmaceutical manufacturers. Recent cases such as this have shown that the government will look closely at speaker programs to ensure that compensation is reasonable and that the services provided are legitimate.

Finally, this case is a significant illustration of the government’s increasing reliance on prescribing information from the Medicare claims database to establish the volume and scope of the allegedly improper prescribing practices – in this matter of Subsys. Relators have begun taking advantage of the ability of private citizens to access such databases to help document allegedly false or fraudulent claims. The government’s complaint in intervention here signals the government’s increasing use of Medicare data in cases, such as this one, in which it decides to intervene.

United States ex rel. Van Der Boom v. Precision Medical Products, Inc., No. 2:15-cv-00428-MCE-KJN (E.D. Cal.)

Complaint Filed: February 24, 2015

Complaint Unsealed: May 23, 2018

Intervention Status: The government intervened on May 18, 2018 for purposes of settlement.

Claims: FCA, 31 U.S.C. § 3729 et seq., AKS, 42 U.S.C. § 1320a-7b, and California False Claims Act (“CFCA”), Cal. Gov. Code § 12650 et seq.

Defendants’ Business: Defendant Precision Medical Products Inc. (“PMP”) is a supplier of durable medical equipment to patients covered by Medicare, MediCal (the California Medicaid program), and Tricare (the federal military health insurance program). Defendant Jeremy Perkins is the founder and owner of PMP. Defendant Marc Reynolds serves as the chief financial officer of PMP.

Relators: Gant Van Der Boom (“Van Der Boom”), Darleen Roland (“Roland”), and Jena Burns (“Burns”).

Relators’ Relationships to Defendants: Van Der Boom is a former PMP sales representative. Roland is the owner of Efficiency Plus Medical Billing (“EPMB”), and Burns is the billing manager of EPMB, which at one time had an agreement to provide medical billing services to PMP.

Relators’ Counsel: Leslie Sindelar Guillon, Gary B. Callahan, and Tatiana Filippova of Arnold Law Firm, and Tiffany B. Wong of Cotchett, Pitre & McCarthy, LLP.

Summary of Case: Shortly after PMP was formed, the company hired relator Van Der Boom as a sales representative. Throughout his time as a PMP employee, Van Der Boom allegedly received commission-payments based on his sales of Medicare, MediCal, and Tricare reimbursed PMP DME. The relators claim that these commissions were unlawful kickbacks because the intention was to reward sales representatives for obtaining orders of DME that were ultimately paid for by the government. The relators also allege that PMP provided fraudulent prescriptions for Medicare-reimbursed DME. While processing PMP’s medical bills, relators Roland and Burn assert that they noticed physician signatures that did not seem to be authentic. At the same time, relator Van Der Boom allegedly witnessed the forgery of physician signatures on order forms, either by tracing an authentic signature through a light source or using a form with a pre-printed physician signature. In addition, PMP purportedly waived Medicare patient co-pays to help patients avoid financial hurdles in obtaining PMP products and either sent patients cheaper equipment than was prescribed or never sent the ordered equipment at all, but nonetheless, it still submitted the original prescription to Medicare for reimbursement. By way of example, Relators Roland and Burns alleged that PMP would remove the hinge from the prescribed knee device and attach it to a cheaper knee device before providing the less expensive product to the patient. Relator Van Der Boom further asserts that when he questioned PMP about these alleged practices, he was demoted and ultimately terminated.

Current Status: On May 4, 2018, the parties entered into a $1.9 million settlement agreement, and the United States then intervened on May 18, 2018 for purposes of settlement. The case was then dismissed by the court on June 8, 2018.

Reasons to Watch: This case demonstrates how potentially fraudulent conduct may be visible to employees dispersed throughout a company. The relators were employed in different areas within PMP but nonetheless witnessed the same alleged misconduct. For example, the claims of fraudulent signatures were noticed by billing administrators but also were observed within the sales department. This indicates that the compliance function within any health care business should be active throughout the entire organization. Conduct implicating the fraud and abuse laws can occur in many parts of a health care entity, and a robust compliance program requires training and reporting avenues for all.

Health Care Qui Tam Litigation Trends

Mintz maintains a database of unsealed health care qui tam actions. This enables us to follow and analyze trends in the cases that have been unsealed. The following are some trends in qui tam filings against health care-related entities in the 12 months that ended August 31, 2018:

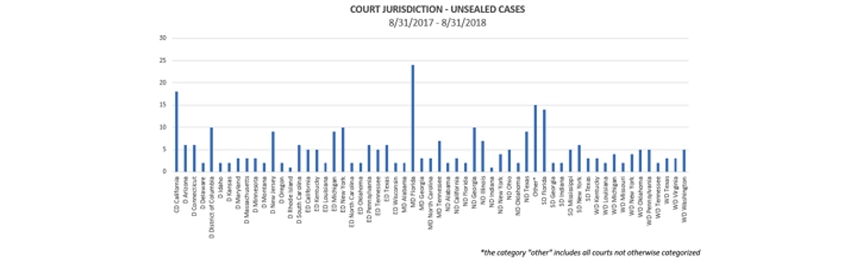

Where were cases filed? Although cases were unsealed in jurisdictions throughout the country, some interesting trends have emerged as to jurisdictions where the most cases have been unsealed:

For the 12-month period that ended on August 31, the Middle District of Florida (Tampa, Orlando, and Jacksonville) continued to be the leading jurisdiction for unsealed cases, followed by the Central District of California (including Los Angeles and Santa Barbara), the Southern District of Florida (Miami, Fort Lauderdale, and West Palm Beach), the District of Columbia, and the Eastern District of New York (Brooklyn, Queens, and Long Island).

Who brought the cases? The ranks of relators are beginning to diversify. In the 12 months that ended August 31, 2018, current and former employees – mostly the latter – continued to dominate the ranks of relators, accounting for 59% of all cases. But significant numbers of relators are now found among customers, industry experts, business partners, consultants, and patients.

How frequently did the government intervene?

Intervention rates continue to be extremely low, with the government electing to intervene in only 16% of cases unsealed in the 12 months that ended August 31, 2018.