Licensing & Technology Transactions

Case Study

Case Study

Mintz represented ImmunoGen in a $200 million non-dilutive royalty transaction of its interest in Kadcyla with funds managed by TPG Special Situation Partners.

Case Study

Case Study

In the first transaction of its kind, Mintz represented Intarcia Therapeutics in two synthetic royalty financings with an equity conversion option valued at $5.5B for ITCA 650.

Case Study

Case Study

Mintz represented ARIAD Pharmaceuticals in a synthetic royalty financing in which PDL BioPharma agreed to provide up to $200 million in revenue interest financing to ARIAD in exchange for royalties on worldwide net revenues of Iclusig (ponatinib).

Case Study

Case Study

Mintz represented Massachusetts General Hospital and Partners HealthCare in a deal that enables them to monetize part of their royalty interests in Entyvio, an antibody used to treat digestive diseases, to invest in research. Royalty Pharma paid $94 million in the true sale roll-up transaction.

Case Study

Case Study

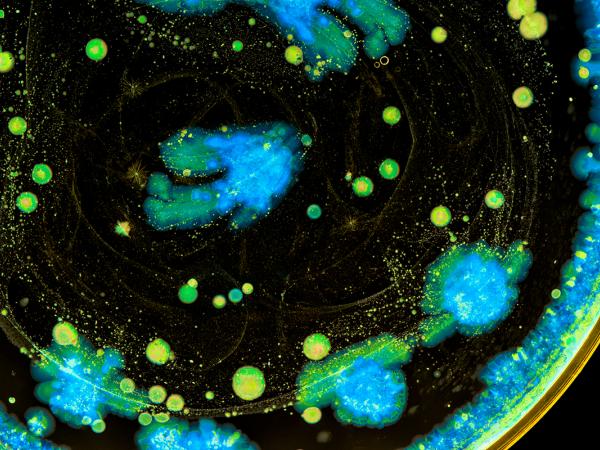

Mintz advised biopharma company Spero Therapeutics on an agreement with Everest Medicines regarding the development and commercialization of a product to treat multidrug-resistant bacterial infections and option to license another.

Case Study

Case Study

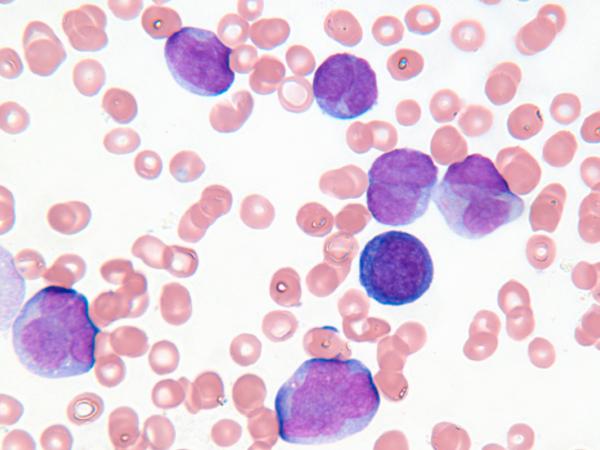

Mintz represented ImmunoGen, a maker of targeted anticancer therapeutics, in a transaction that netted $194 million. The deal provided ImmunoGen with cash and liquid assets in exchange for assigning certain royalty revenues for the breast cancer treatment Kadcyla to TPG Special Situations Partners.

Case Study

Case Study

Mintz attorneys negotiated a termination agreement with a large Indian technology vendor that had failed to meet the terms of its contract. The successful negotiation eased the client's transition to a new vendor while preserving the client's right to enforce claims against the old provider.

Case Study

Case Study

Mintz attorneys served as lead lawyers in the negotiation of a transaction for the procurement of a software as a service (SaaS) care management platform. The resulting arrangement greatly bolstered our client's bottom line.

Case Study

Case Study

Mintz served as lead counsel to a major multinational mutual fund and financial services company in a multiyear initiative to purchase cloud computing services that will be used across the client's global enterprise.

Case Study

Case Study

Mintz has represented oncology-focused biotherapeutic company Inhibrx LP since its inception. Mintz attorneys have advised Inhibrx on licensing deals and financing deals involving unusual corporate and tax structuring and international aspects.

Case Study

Case Study

Mintz represented BeiGene, Ltd. in its global strategic collaboration with Celgene Corporation to develop and commercialize BeiGene’s cell death protein 1 (PD-1) inhibitor tislelizumab (BGB-A317) for patients with solid tumor cancers. Mintz also assists BeiGene with licensing transactions.