Mergers & Acquisitions

Life Sciences & Health Care

- Represented Viela Bio, Inc. (Nasdaq: VIE), a biotechnology company, in its $3.05B sale to Horizon Therapeutics plc (Nasdaq: HZNP), a specialty and generic drug manufacturing company

- Represented Fulgent Genetics, Inc., a technology-based genetic testing company, in its $60M acquisition of CSI Laboratories

- Represented Walk Vascular, commercial-stage medical device company that has developed systems for the minimally invasive removal of peripheral blood clots, in its sale to Abbott (NYSE: ABT), a medical device company

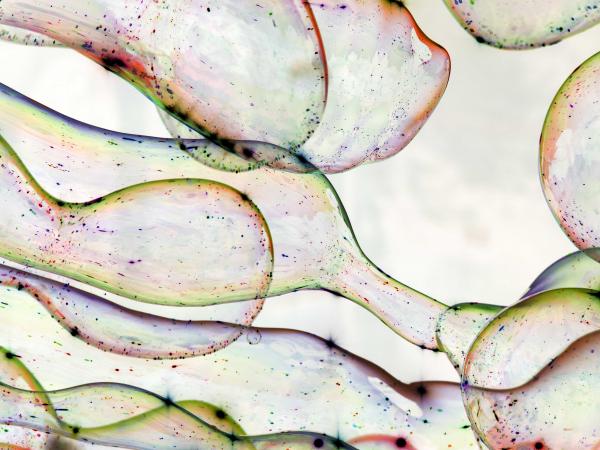

- Represented QIAGEN N.V. (NYSE: QGEN), a Germany-based provider of life science and molecular diagnostic solutions, in multiple transactions, including its cross-border acquisition of NeuMoDx Molecular, Inc., a US-based company that designs and develops molecular diagnostic solutions for hospital and clinical reference laboratories, its acquisition of the digital pcr assets of Formulatrix, Inc., its strategic partnership with NeuMoDx Molecular, Inc., its acquisition of Ingenuity Systems, Inc., as well as its acquisition of SA Biosciences Corporation

- Represented Myriad Genetics, Inc. (NASDAQ: MYGN), a molecular diagnostic company, in multiple acquisitions, including its sale of Myriad RBM, Inc., which specializes in contract research services for the pharmaceutical industry, to Q2 Solutions, its acquisition of Counsyl, its acquisition of Assurex Health, as well as its acquisition of Crescendo Bioscience, Inc.

- Represented Philips Healthcare in connection with dozens of mergers and acquisitions and other strategic transactions in the areas of diagnostic imaging and ultrasound, image-guided therapy, patient care and monitoring solutions, sleep and respiratory care, therapeutic temperature management, healthcare informatics and population health management, and health and wellness

- Represented Quanterix Corporation (NASDAQ: QTRX), a company digitizing biomarker analysis to advance the science of precision health, in its acquisition of UmanDiagnostics AB, the world’s leading Nf-L antibody supplier

- Represented Censa Pharmaceuticals, Inc., a biopharmaceutical company, in its sale to PTC Therapeutics, Inc. (NASDAQ: PTCT), a global biopharmaceutical company

- Represented Biogen Inc. (NASDAQ: BIIB), a biotechnology company, in the $900M sale of a biologics manufacturing facility to FujiFilm Corporation, a photography and imaging company

- Represented Orgenesis Inc. (NASDAQ: ORGS), in the sale of its stake in its Mastercell Global, Inc. subsidiary to Catalent Pharma Solutions for a total purchase price of $315M, of which Orgenesis received approximately $127M of net proceeds

Technology

- Serving as legal counsel to Brooks Automation, Inc. (NASDAQ: BRKS) (Brooks), a leading provider of life science sample-based solutions and semiconductor manufacturing automation solutions worldwide, in the proposed sale of its Semiconductor Solutions business to private equity firm Thomas H. Lee Partners, L.P. (THL) for $3B in cash

- Represented International Data Group, Inc., a subsidiary of China Oceanwide Holdings Group, Co. Ltd., in its $1.3B sale to private equity funds of Blackstone

- Represented Astadia, Inc., a software solutions mainframe-to-cloud migration business, in its acquisition of Anubex, a Belgium mainframe migration and refactoring business

- Represented Asavie, a provider of technology solutions and services to businesses in respect of the management, security, control, and policies for mobile and Internet of Things devices, in its sale to Akamai Technologies, Inc. (NASDAQ: AKAM)

- Represented LeanIX, a Software-as-a-Service (SaaS) company that manages Enterprise Architecture and multi-cloud environments, in its acquisition of Cleanshelf Inc., an enterprise Software-as-a-Service (SaaS) management solution

- Represented the selling stockholders of Financière Asteelflash Group (FAFG), a French electronics manufacturer, in its sale to Universal Scientific Industrial (Shanghai) Co., Ltd. (USI), an electronic designer and manufacturer

- Represented 55ip, a financial technology company with proprietary capabilities empowering financial advisors to deliver tax-smart investment strategies at scale, in its sale to J.P. Morgan Asset Management

- Represented Netsmart Technologies Inc. in multiple transactions, including its acquisition of Tellus, a provider of Electronic Visit Verification (EVV), mobile care delivery and claims processing technology designed especially for the home health, long-term care, state and human services markets, and its purchase of the ownership interests in Quality in Real Time Inc., a healthcare coding and consulting company

- Represented eBay in the sale of its approximately $1.1 billion stake in India-based Flipkart in connection with Walmart's investment in Flipkart; Mintz attorneys previously served as U.S. counsel to eBay in its exclusive agreement to jointly address the eCommerce market opportunity in India whereby in exchange for an equity stake in Flipkart, eBay made a $500 million cash investment in Flipkart and simultaneously sold its eBay.in business to Flipkart

- Represented Dassault Systèmes in multiple transactions, including its acquisition of IQMS, Inc. and its acquisition of No Magic Incorporated

Financial Services

- Represented JMP Group LLC, a capital markets firm that provides investment banking services, in its sale to Citizens Financial Group, Inc. (NYSE: CFG)Represented BMS Investment Holdings Limited, an insurance and reinsurance broker, in its acquisition of Trean Intermediaries, a reinsurance broker and services company

- Represented LPL Financial (NASDAQ: LPLA) in its acquisition of Blaze Portfolio Systems, LLC, a trading and portfolio rebalancing software company

- Represented LPL Financial (NASDAQ: LPLA) in its asset purchase of EK Riley Investments, LLC, a broker-dealer and registered investment advisor

- Represented LPL Financial (NASDAQ: LPLA) in its acquisition of AdvisoryWorld, a provider of digital solutions designed to help financial advisors attract and serve client assets

- Represented John Hancock Financial Network Inc. in its sale of Signator Investors, a dual-registered broker-dealer and investment advisor, to Advisor Group, one of the nation's largest networks of independent financial advisory firms

- Represented John Hancock Financial Network Inc. in its acquisition of Transamerica Financial Advisors Inc., a broker-dealer and registered investment advisor

- Represented John Hancock Financial Network Inc. in its purchase of Symetra Investment Services, a dual registered broker-dealer and registered investment adviser

- Represented Adviser Investments, an asset management and wealth advisory firm, in connection with an investment by Summit Partners, a private equity firm

- Represented Congress Asset Management, an investment management firm, in its strategic investment from CI Financial Corp., an independent company offering global asset management and wealth management advisory services

- Represented Lexington Wealth Management LLC, a registered investment advisor, in its sale to HighTower, a registered investment advisor consolidator

Retail & Consumer Products

- Represented Apex Global Brands Inc. (OTC: APEX), a global brand management and licensing organization that markets a portfolio of high-quality lifestyle brands, in its sale to Galaxy Universal LLC, a wholesaling, sourcing, and brand management company

- Represented cloud computing company Rocket Innovations, Inc. in the sale of Rocketbook, the leading smart reusable notebook brand in the United States, to BIC, a global manufacturing company of disposable consumer products such as stationery, lighters, and shavers

- Represented Seventh Generation, Inc., a company that sells eco-friendly cleaning, paper, and personal care products, in its sale to Unilever

- Also represented Seventh Generation in its acquisition of Move Collective LLC, a green consumer goods company

- Represented Tatcha, a rapidly growing luxury beauty company with a focus on e-commerce combined with a global retail presence, in its acquisition by Unilever

- Represented Revision Military Limited, leader in protective eyewear solutions for military and tactical use, in the sale of its eyewear business to ASGARD Partners & Co., a private equity firm based in New York, and Merit Capital Partners, a private equity firm based in Chicago

- Represented Manischewitz, a leading brand of kosher products, in its sale to Kenover Marketing Corp.

- Represented Charlotte Russe, Inc., a women’s clothing retailer with 45 retail locations, in the acquisition of Peek, Aren’t You Curious? Inc.

- Represented Jacqueline's Wholesale Bakery, a manufacturer of frozen cookie dough for the in-store bakery and foodservice channels, in connection with its sale to Rich Product Corporation

- Represented Calera Capital in a leveraged recapitalization of a supplier of wallcoverings to the corporate, healthcare, hospitality and education building markets

- Represented The Paper Store, LLC, a chain of specialty gift stores, in its equity recapitalization with private equity firm WestView Capital Partners (also acted as debt finance counsel to client and WestView)

Industrial & Manufacturing

- Represented Feeney Utility Services Group (FUSG), a leading provider of maintenance, repair, and upgrade services to natural gas utilities in the Northeast, in its sale to Artera Services, LLC - also represented FUSG in its recapitalization with CAI Private Equity and in multiple debt financing transactions

- Represented FYDEC Holding SA, a holding company of Dietrich Engineering Consultants, in its cross-border acquisition of Extract Technology, a provider of containment and aseptic systems for the pharmaceutical, biotech, nuclear and chemical markets, from Wabash National Corporation

- Represented E.L. Harvey & Sons, the largest family-owned and operated solid waste services company in Massachusetts, in its sale to Waste Connections, Inc. (TSX/NYSE: WCN), an integrated solid waste services company

- Represented Lacerta Group, a manufacturer of thermoformed packaging solutions, in its sale to private equity firm SK Capital

- Represented a large family office in the leveraged buyout of a regional paving company based in the mid-West

- Represented H.I.G. Capital in its investment in Construction Forms, Inc. (Con Forms), a leading manufacturer of piping systems and accessories for concrete, mining, power generation, and other industrial applications

- Represented Laddawn Inc., a manufacturer of blown polyethylene bags and films, in its sale to Berry Global Group, Inc.

- Represented MMi Sonora, a specialized contract manufacturer of precision machined components, in its acquisition by ARCH Global Precision, a portfolio company of The Jordan Company

- Represented MPE Partners in multiple transactions, including its recapitalization of Voeller Mixers, Inc., a manufacturer of batch plants and mixing equipment for concrete, glass, and related industries, in its recapitalization and sale of Trachte, Inc., a manufacturer of preassembled and modularized control buildings, and in its acquisition and sale of United Pipe & Steel Corp., a distributor of commodity pipe products - also represented United Pipe & Steel Corp. in its sale to Merfish, a pipe supplier

- Represented American Technical Ceramics Corp., a publicly traded manufacturer of electronic components, in its sale to AVX Corporation

Case Study

Case Study

Mintz advised Wavecrest on its acquisition of Dealerware, enhancing growth in auto‑tech with a platform serving 60,000+ vehicles across nearly 2,000 dealerships.

Case Study

Case Study

Mintz advised Charlesbank on its strategic growth investment in HBox, supporting the virtual care leader’s expansion and strengthening Mintz’s cross-border PE practice.

Case Study

Case Study

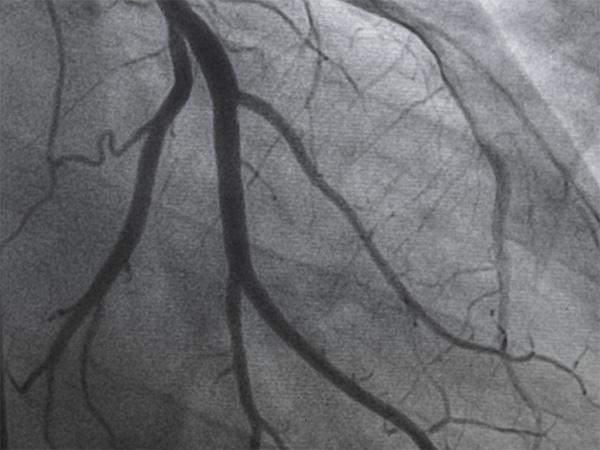

Mintz advised Royal Philips on its agreement to acquire SpectraWAVE, enhancing Philips’ intravascular imaging and AI-driven physiology solutions for coronary artery disease treatment.

Case Study

Case Study

Mintz advised SILAC, Inc. on its definitive agreement to be acquired by Hildene Capital Management.

Case Study

Case Study

Mintz advised Diamond Antenna and Microwave Corporation, and a portfolio company of Artemis Capital Partners, on its acquisition of Antenna Associates.

Case Study

Case Study

Mintz advised Point72 and Tsunami Express in acquiring 53 car wash sites from Whistle Express, expanding Tsunami’s Midwest footprint to 74 locations.

Case Study

Case Study

Mintz advised the former shareholders of biopharmaceutical company Censa Pharmaceuticals, Inc. in the sale of their sepiapterin earnout royalty rights back to PTC Therapeutics, Inc. (NASDAQ: PTCT) in accordance with a Rights Satisfaction Agreement.

Case Study

Case Study

Mintz advised on Gallion Health’s spinout from the University of Maryland Medical System (UMMS), marking the first company to emerge from the health system’s technology and incubation studio, iHarbor Innovation Center.

Case Study

Case Study

Mintz advised PHLUR, a modern fragrance brand recognized for its emotion-led storytelling and accessible positioning, in its acquisition by TSG Consumer, a leading private equity firm specializing in consumer brands.

Case Study

Case Study

Mintz advised CVC DIF, the dedicated infrastructure investment strategy of global private markets manager CVC, in its agreement to acquire SBA Communications’ Canadian wireless tower business, one of Canada’s leading independent owners and operators of wireless communications towers. The transaction is expected to close in the fourth quarter of 2025, subject to customary closing conditions.

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study

Case Study