Securities & Capital Markets

Paving Your Pathway to the Public Markets

Going public? Go Mintz. We are uniquely qualified to help you go public and transition to life as a public company. Our attorneys serve as both company-side and underwriter-side counsel. With guidance that reflects a deep understanding of the particular challenges in bringing a company to the public markets. That's why innovative companies turn to us for their IPOs.

|

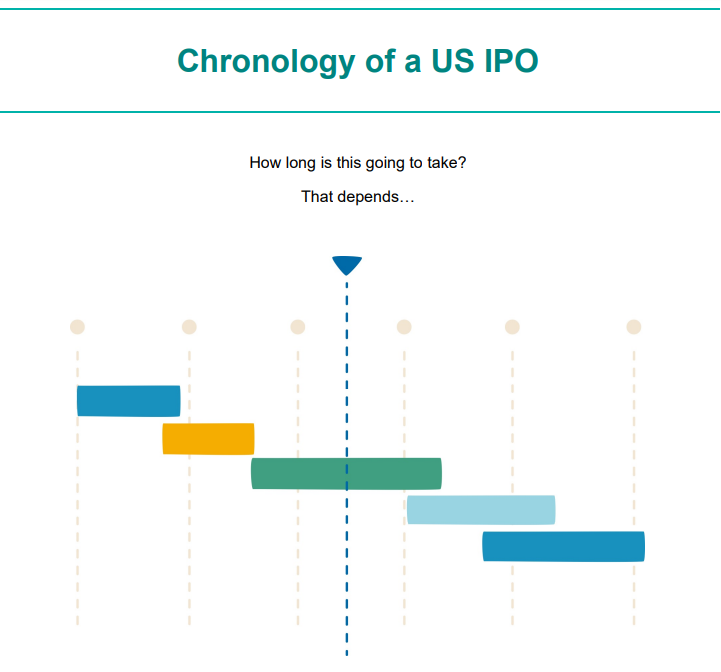

We invite you to use our updated IPO Timetable, which provides an overview of typical events in an IPO and the parties responsible.

Share Awards

Our Experience

Case Study

Case Study

Mintz advised client ArriVent BioPharma, a clinical-stage company dedicated to accelerating the global development of innovative biopharmaceutical therapeutics, on its upsized $175 million IPO on Nasdaq.

Public companies ─ based both domestically and internationally ─ rely on Mintz as securities counsel

Case Study

Case Study

Mintz advised the underwriters in connection with a $230 million public offering by Cogent Biosciences, Inc. of 25,555,556 shares of common stock, which includes 3,333,333 shares issued pursuant to the exercise in full by the underwriters of their option to purchase additional shares of common stock, offered at a public offering price of $9.00 per share.

Areas of Focus

Our Approach

Selecting Mintz as securities counsel is a smart choice for issuers and underwriters alike. For company clients, we help navigate the challenges associated with going public, and life as a public company. Like capital-raising transactions and the complex disclosure requirements involved in public company reporting. Sarbanes-Oxley and Dodd-Frank Act compliance. And corporate governance, shareholder relations, and equity compensation planning. We also provide board- and committee-level counsel and strategic advice. With underwriters, we're regarded as a "go-to" firm because we've earned a reputation for developing creative deal structuring solutions. (Ask us about our track record with reverse mergers and alternative public offerings.) They also appreciate our unified approach to client service, industry-specific due diligence, and commitment to practicality and executing on agreed-upon timelines.

-

Capital-raising transactions, including IPOs and follow-on offerings

- Mergers and acquisitions involving public company securities

-

Executive and equity compensation planning and implementation

-

Shareholder communications and reporting

- SEC compliance policies and procedures

-

Stock exchange listing and compliance

-

Board and committee advice

-

Corporate governance strategies

-

SEC and stock exchange reporting

-

Securities education and training

Mintz is counsel to a broad range of the world's leading investment banks as well as many industry-focused niche firms.

What Our Clients Are Saying

Meet Mintz

Our collaborative attorneys are known for their dedication to client service and their talent for developing smart, creative solutions.

Our Insights

Viewpoints

Preparation for 2023 Fiscal Year-End SEC Filings and 2024 Annual Shareholder Meetings

December 15, 2023| Advisory

SEC Issues Guidance Easing Broker Search Timing Requirements for Proxy Materials

January 28, 2026| Article